Parents in the province are already checking their bank accounts as the school year kicks off after another pricey summer.

But there are a few ways money will be coming in this year if you are a parent or a caregiver — at least if you are eligible for them.

Youth sports grant

Kids playing soccer on an artificial turf field / Shutterstock

Getting your kid on the field isn’t cheap, and depending on the sport, it can become downright shocking when you add up the registration fees, training camps, and equipment. The KidSport Youth sports grant is $400 a year for “a sustained sport experience led by a qualified coach for a minimum of six weeks with at least one session per week” and doesn’t cover the cost of the equipment or the travel to playoffs, but will go towards registration costs.

Who qualifies: Family size and income before taxes are used to determine eligibility.

- 2 people: $45,000

- 3 people: $54,000

- 4 people: $65,250

- 5 people: $74,000

- 6 people: $83,500

- 7+ people: $93,000

While it comes down to income, there are exceptions, and those with questions are encouraged to contact the organization as soon as possible before the season starts.

Clothing and shoes

Oksana Kuzmina/Shutterstock

Another ongoing saving many parents might be missing out on is PST exemptions. There are tax-free benefits if you buy clothes, blankets, shoes, school supplies, and accessories for children in BC, and you might just have to ensure it’s done when you pay at the register.

Who qualifies: Some items aren’t on the list, but garments and shoes are covered as long as you shop for your child. If your child is wearing adult clothes and is under 15 years old, those items are also exempt from the 7% tax. You just have to specify when you are buying them and show proof if they ask.

Student and Family Affordability Fund

Ground Picture/Shutterstock

That said, the tax-free perk can only get you so far. That’s where the Student and Family Affordability Fund comes in. It is designed to work alongside the school to help with fees, supplies, and clothing. It also offers financial assistance for participating in field trips and music programs and can provide nutritional meals. The program was given a $20 million provincial funding bump this spring.

Who qualifies? The BC government’s website does not provide eligibility details and only states that interested applicants are encouraged to speak with the school’s principal to learn how to access these programs.

BC Family Benefit

Krakenimages.com/Shutterstock

This one is automatic if you have kids under 18, but a bonus was recently added to it, which might help offset inflation. Families this year are expected to get $445 more than last year, on average, through the monthly tax-free payments. This means a single parent with one child could receive $2,688 annually, while a family of four could get up to $3,563 annually, the province said.

After this month, families can expect the next payments to be made monthly through June 2025 and be tax-free.

Who qualifies: No action is required beyond filing your taxes. You can calculate how much your family will receive on the provincial site, but if you make less than $35,902, you are eligible for the largest amount, and those earning more than $114,887 per year get a reduced amount. Single parents are eligible for up to a $500 per year supplement.

Training and education savings grant

Andrey_Popov/Shutterstock

This one really is free money. You can apply for a $1,200 grant to contribute to your child’s RESP to help save for post-secondary or training programs as long as your child has a valid Social Insurance Number and is a resident of BC when they apply.

Who qualifies: You can apply for your child at any bank or credit union between their sixth birthday and the day before their ninth birthday.

Childcare costs

Oksana Kuzmina / Shutterstock

There are many different options for getting some cash to help cover those daycare or childminding costs. Childcare providers can apply to the Child Care Fee Reduction Initiative, which will then pass on the savings to the families. The way to get this one is to find a participating childcare provider who has been accepted into the initiative. If they charge you a waitlist fee, report them to the province.

While you’re looking, see if you can score a spot in a $10-a-Day ChildCareBC centre, which provides exactly what its name describes to a max of $200 per month per child for care. There are 15,000 centres across BC, but we know it’s challenging in Metro Vancouver to still get a spot! Here’s the map to start you off.

For families with a pre-tax income of $111,000 or less, the Affordable Child Care Benefit might help cover the costs of childcare.

Lastly, if you are a parent under 25 and finishing high school, you are eligible for the Young Parent Program, which provides up to $1,500 per month per child.

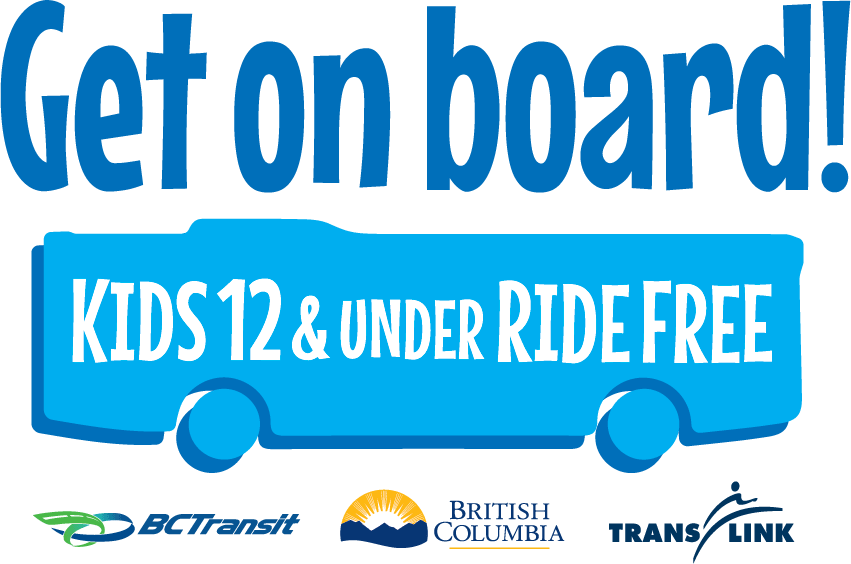

Free transit

Getting to school can be expensive, too, so there are some savings if you can switch to transit. Kids 12 years and under can take the bus, SkyTrain, SeaBus, and West Coast Express for free through both BC Transit and TransLink. It’s a bit tricky when it comes to the SkyTrain as you can’t raise the gates without the pass, so in that case, chat with an attendant or pick up the closest phone to get help through the fare gates, the company explained.

Who qualifies: Kids 12 and under. Kids older than 13 can get a discounted fair.

- You might also like:

- Dressew Supply to close after 61 years and sell Vancouver buildings

- "Not impressed": Residents divided on car-free Gastown

- With the high cost of living, how are Canadians with kids managing their expenses?

- Many BC students can't afford cost of school, basic necessities: TD

This piece was first published in August but has since been updated