You now need to make $253,000 to afford an average Vancouver house

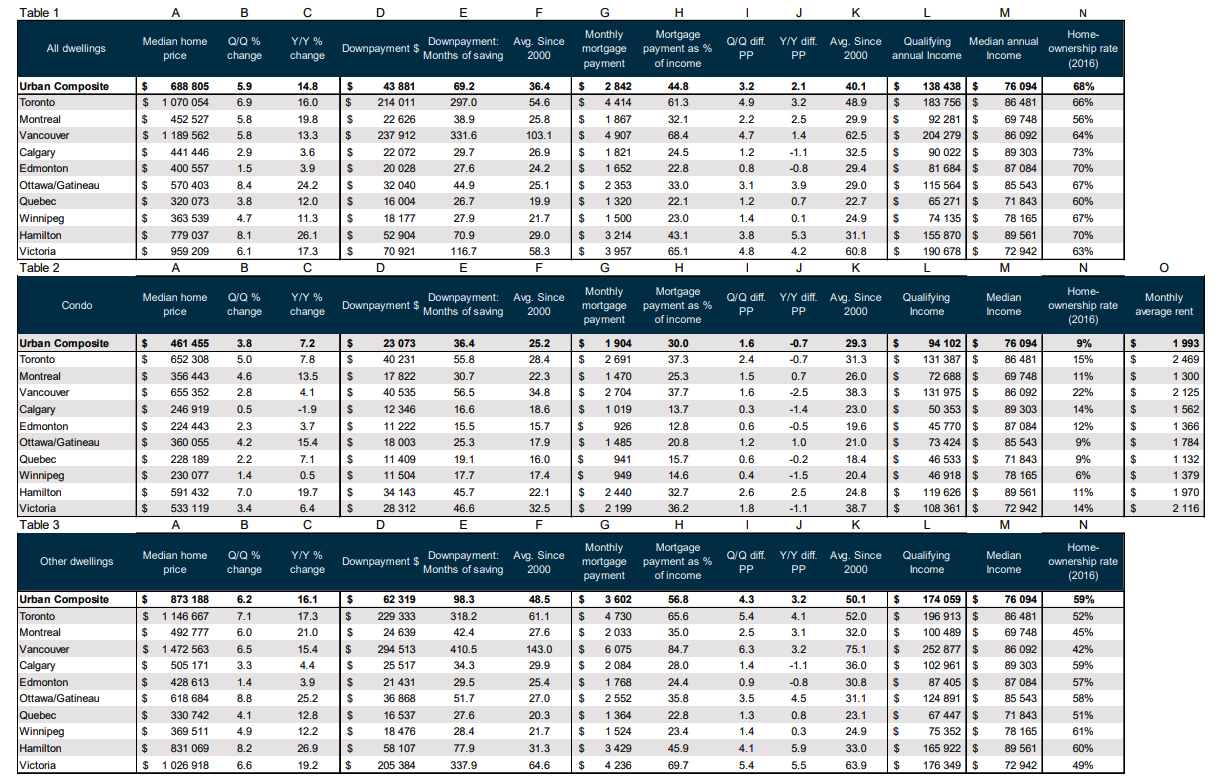

The housing affordability chasm in Metro Vancouver is measured in a new report by the National Bank of Canada, which found that an annual household income of $253,000 is now needed to afford an average house in the region worth $1.47 million.

It would also take 411 months (34.3 years) of savings to cover the down payment for this home type, with a saving rate of 10%.

- See also:

- Vancouver housing is officially less affordable than New York or LA

- Opinion: Vancouver’s housing crisis is worse than ever, so what are we doing about it?

- 14% of Metro Vancouver’s young homeowners have more than one property: report

- Vancouver-area homes are now even less affordable thanks to new stress test

- Canada has the lowest number of homes per 1,000 residents in any G7 country

Condominium homes, of course, provide a greater degree of affordability compared to a single-detached dwelling or a townhouse. But with an average price of $655,000 for a representative condominium in this market, it would still require an annual household income of $132,000 to afford a unit, with 57 months (4.8 years) of savings required for the down payment.

Over the past 12 months, home prices increased by 5.8% across the board, including 6.5% for single-family dwelling houses and townhouses, and 2.8% for condominiums.

National Bank of Canada

National Bank of Canada

Mortgage payments in Metro Vancouver are also taking up an overwhelming portion of homeowners’ incomes, with 84.7% of the paycheque (up 5.4% from the previous quarter) for single-family dwelling houses and townhouses, and 37.7% for condominiums (up 1.6% from the previous quarter).

In steep contrast, 45% is the national rate for how much of a typical mortgage payment eats up household income.

Currently, monthly mortgage payments on a median priced condominium in Metro Vancouver are approximately 29% higher than the average monthly market rent of about $2,100. But this condominium mortgage-to-rent gap has been narrowing in recent years.

“Income growth and lower interest rates were conducive to improving affordability for most of the past two years,” reads the report.

“That is no longer the case in 2021, as income growth is being easily outpaced by home price increases, while mortgage interest rates also rose on a quarterly basis.”

National Bank of Canada

Unsurprisingly, Metro Vancouver continues to lead Canada in housing costs amongst major markets, but affordability in Toronto and Victoria dropped by the greatest percentages. In fact, Vancouver saw the biggest improvement, percentage wise.

Mortgage payments in Toronto are taking up even more of homeowners’ paycheques. For non-condo owners, it is costing them 65.6% of their income(up 5.4% from the previous quarter). For condo owners, it’s 37.3% of their earnings (up 2.4% quarter-over-quarter).

In Toronto, a typical house that’s representative of the current real estate market is priced at $1,147 million. To afford this home, a buyer needs a household income of $197,000 and would — assuming a saving rate of 10% — have to have saved up for 318 months (26.5 years).

The representative condo in Toronto is priced at $652,000. And to afford that, you’ll need a household income of $131,000 and 56 months (4.7 years) of savings.

National Bank of Canada

Housing affordability statistics. Click on the image for an enlarged version. (National Bank of Canada)

- See also:

- Vancouver housing is officially less affordable than New York or LA

- Opinion: Vancouver’s housing crisis is worse than ever, so what are we doing about it?

- 14% of Metro Vancouver’s young homeowners have more than one property: report

- Vancouver-area homes are now even less affordable thanks to new stress test

- Canada has the lowest number of homes per 1,000 residents in any G7 country