Uber's proposal to expand to Victoria and Kelowna rejected by BC

The authority that regulates ridehailing and taxi services in British Columbia has rejected Uber’s application to expand into other areas of the province outside of Metro Vancouver and the Fraser Valley.

After receiving Uber’s application in September 2020, the Passenger Transportation Board (PTB) released its ruling this week, rejecting the ridehailing giant’s proposal to expand into Transportation Network Services’ (TNS) five other regions. If the application had been approved, Uber would have begun its BC expansion in the Victoria and Kelowna regions.

- You might also like:

- Uber announces plan to launch ridehailing in Victoria and Kelowna

- Uber and Lyft trips in Metro Vancouver now outnumber taxis 2-1

- Uber drivers in Metro Vancouver making average of $24 per hour after costs

- Metro Vancouver residents believe ride-hailing is better than taxis in key factors: survey

- Metro Vancouver taxi companies lose court challenge against Uber and Lyft

In its ruling, PTB stated its decision was based on continued COVID-19 impacts on point-to-point transportation services, specifically taxi companies. It concluded that introducing ridehailing to more regions at this time, when overall passenger demand has declined, would further impede on the ability of taxi companies to recover from the pandemic.

“The Board is concerned that granting this Application at this time would unduly harm existing TNCs and taxi companies. It finds the markets in the Regions applied for are unable to absorb more competition at this time. Having given due consideration to all of the evidence and submissions, the Board refuses the Application at this time,” reads the decision.

“In this Application, the Board is satisfied that Uber is fit, proper and capable of providing the proposed service. In the current circumstances, however, the Board is not convinced that there exists a public need for the service applied for. Further, the Board considers that the Application, if granted at this time, would not promote sound economic conditions in the passenger transportation business in BC.”

PTB suggests that Uber’s application would have been approved “in normal economic times,” as the board “has accepted that declines and increases in the taxi share of the business will occur before and after the introduction of TNS.”

Moreover, “it is the Board’s view that, generally speaking, the economic interests of the transportation business overall weigh more heavily than the economic and financial interests of any particular applicant or submitter.”

“The Board has made clear that it does not consider TNS and taxi service to be equivalent such that the existence of one negates any need for the other.”

But based on the findings of an independent consultant report commissioned by the PTB on the impacts of ridehailing services in TNS’ Region 1 of Metro Vancouver, the Fraser Valley, and the Sea-to-Sky corridor reaching Whistler, the board states there is evidence that the presence of Uber and Lyft has “delayed the recovery of the taxi industry in the Lower Mainland.”

This is the result of the combination of factors such as passengers choosing convenient and predictable app-based ridehailing services over taxis, the pandemic’s impact on the availability of drivers, the shortage of drivers due to the backlog in ICBC testing for Class 4 licenses, and the difference in the PTB’s regulated rate structure for TNS and taxis, which encourages the same pool of drivers to move from operating taxis to driving their own vehicles for ridehailing.

The consultant found that taxi trip volumes in the Lower Mainland fell by a rate that was “much more than the decline from COVID alone in other regions,” and that it is clear that from the statistics that ridehailing grew at the expense of the taxi industry.

Fluctuating number of trip volumes for taxis and Transportation Network Services (TNS), also known as ridehailing, within BC’s TNS Region 1 of the Lower Mainland and Sea to Sky Corridor. (Hara Associates/BC Passenger Transportation Board)

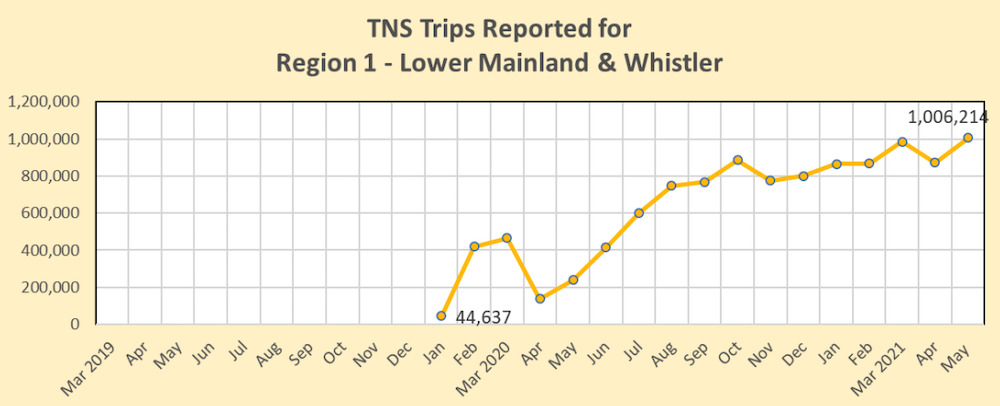

Fluctuating number of trip volumes for Transportation Network Services (TNS), also known as ridehailing, within BC’s TNS Region 1 of the Lower Mainland and Sea to Sky Corridor. (Hara Associates/BC Passenger Transportation Board)

According to the consultant’s data, when ridehailing services Uber and Lyft finally launched in Metro Vancouver in late January 2020, both companies made a combined total of 44,600 trips in just the final week of that month.

The use of ridehailing in this region then grew by almost tenfold to 420,000 in February 2020. At the same time, the estimated total taxi trips fell from 1.549 million in January 2020 to 1.362 million in February 2020.

With the sudden onset of COVID-19 in March 2020, the number of trips collapsed, and April 2020 saw the lowest number of trip volumes during the pandemic for both types of services, with taxis at 249,000 and ridehailing at 139,000.

Fast forward to May 2021, when economic recovery and mass vaccination efforts were well underway, and the market completely shifted to ridehailing dominance: As of the middle of Spring 2021, for every trip that was made by taxis in the Lower Mainland, nearly two other trips were made by ridehailing.

In May 2021, a total of 1.006 million trips were recorded on ridehailing in Region 1, compared to 589,000 by taxi. The combined ridehailing and taxi trips made over this particular month totalled 1.595 million — not too far off May 2019’s taxi total number of trips of 1.727 million. The gap between ridehailing and taxis likely further increased beyond May 2021 from further rebounds in the economy and travel over much of the latter half of this year.

In its ruling, PTB has indicated dozens of taxi companies provided input on Uber’s proposal, and accounted for most of the opposition.

While the board sided with taxi companies, it dismissed the Vancouver Taxi Association’s (VTA) assertion that the consultant’s data is insufficient and unreliable: “The Board rejects the VTA’s submission that the data in the Report is insufficient and unreliable. The Board finds that the data provided in the Report is reliable and the estimates are reasonable.”

In fact, the PTB stated it “appreciates” the ease of ridehailing’s app-based technological capabilities of providing the required trip statistics, which is not the case for the taxi industry across the province. Although taxis cooperated with the consultant, they are still adjusting to the PTB’s new data reporting requirements. The consultant found the data provided by taxi companies to be “incomplete,” requiring the need to make informed estimates.

Daily Hive Urbanized reached out to Uber Canada for comment on the PTB’s decision.

“The Passenger Transportation Board’s decision is surprising, disappointing and inconsistent with what we hear from communities like Victoria and Kelowna,” reads the company’s statement.

“There is meaningful public demand for ridesharing services, as demonstrated by the support from local community and business organizations, and the strong uptake of ridesharing in Metro Vancouver since we launched. British Columbians have been clear that they want access to the same safe, reliable rides available in communities around the world. Uber will review the full decision and make a decision regarding next steps in the coming weeks.”

According to Uber, there have been tens of thousands of opens of their app in Victoria and Kelowna each over the last year, which is proof of the demand for their ridehailing services.

Major business and community organizations such as the Victoria Airport Authority, Greater Victoria Chamber of Commerce, BC Federation of Students, BC Restaurant and Foodservices Association, and Tourism Kelowna, as well as the City of Victoria and City of Langford have all expressed their clear support for Uber’s expansion.

The PTB commissioned the consultant report for the sole purpose of assisting in its decision on Uber’s application to expand in more BC regions.

In July 2023, the PTB’s Special Committee will review in detail the impact of ridehailing services on the taxi industry.

Uber service map in Metro Vancouver and the Fraser Valley, January 2021. (Uber)

- You might also like:

- Uber announces plan to launch ridehailing in Victoria and Kelowna

- Uber and Lyft trips in Metro Vancouver now outnumber taxis 2-1

- Uber drivers in Metro Vancouver making average of $24 per hour after costs

- Metro Vancouver residents believe ride-hailing is better than taxis in key factors: survey

- Metro Vancouver taxi companies lose court challenge against Uber and Lyft