Uber and Lyft trips in Metro Vancouver now outnumber taxis 2-1

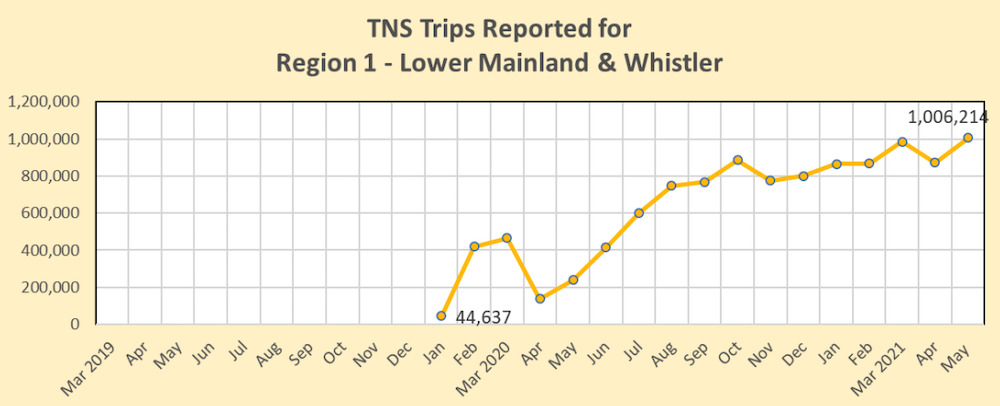

When ridehailing services Uber and Lyft finally launched in Metro Vancouver in late January 2020, they made a combined total of 44,600 trips in just the final week of that month.

The use of ridehailing in this region then grew by almost tenfold to 420,000 in February 2020. At the same time, the estimated total taxi trips fell from 1.549 million in January 2020 to 1.362 million in February 2020.

- You might also like:

- Uber drivers in Metro Vancouver making average of $24 per hour after costs

- Uber announces plan to launch ridehailing in Victoria and Kelowna

- Metro Vancouver residents believe ride-hailing is better than taxis in key factors: survey

- With few riders, Metro Vancouver taxi parking lots are looking full (PHOTOS)

With the sudden onset of COVID-19 in March 2020, the number of trips collapsed, and April 2020 saw the lowest number of trip volumes during the pandemic for both types of services, with taxis at 249,000 and ridehailing at 139,000.

Fast forward to May 2021, when economic recovery and mass vaccination efforts were well underway, and the market completely shifted to ridehailing dominance. As of the middle of Spring 2021, for every trip that was made by taxis within the same operating area as Region 1 of BC’s Transportation Network Service (TNS; ridehailing) regime — entailing Metro Vancouver, Fraser Valley, and the Sea to Sky Corridor, including Whistler — nearly two other trips were made by ridehailing.

In May 2021, a total of 1.006 million trips were recorded on ridehailing in Region 1, compared to 589,000 by taxi. The combined ridehailing and taxi trips made over this particular month totalled 1.595 million — not too far off May 2019’s taxi total number of trips of 1.727 million.

Fluctuating number of trip volumes for taxis and Transportation Network Services (TNS), also known as ridehailing (Uber/Lyft), within BC’s TNS Region 1 of the Lower Mainland and Sea to Sky Corridor. Click on the image for a larger version. (Hara Associates/BC Passenger Transportation Board)

These are some of the statistics compiled in a newly released report by ridehailing consulting firm Hara Associates, commissioned by the provincial government’s independent BC Passenger Transportation Board (PTB).

Researchers pulled data and analyzed the effects of ridehailing across BC. However, as of May 2021, 99.99% of TNS trips in BC were in Region 1, led by Uber and Lyft, which are currently limited to operating in this Lower Mainland region. The study examined data between May 2019 and May 2021, but with economic recovery and normalization accelerated throughout the summer and into fall, there is every reason to suspect the gap between ridehailing and taxis as of November 2021 is now even wider than in this past spring.

The study’s findings will help the PTB decide the submitted applications to expand ridehailing in BC, with Uber submitting an application to expand to the remaining four TNS regions in the province, and Toronto-based Facedrive submitting an application for Region 1. However, Facedrive has faced a turbulent period over the last few months, and its future is now uncertain.

The taxi industry saw an initial blow from the greenlighting of Uber and Lyft, and then within just a matter of weeks, a second much larger blow from the pandemic. Although the ridehailing giants were also greatly impacted early in the pandemic, they were able to take advantage of the “reset” underway in the transportation market.

“Overall, it appears TNS companies began operation just prior to the advent of COVID, suffered an immediate setback, and then went on to grow and capture half the COVID depressed market for trips,” reads the report.

Researchers state vehicle-for-hire services need to be introduced into markets at scale in order to cover a large area, if they are to achieve high service levels without having passengers to wait for a long time for a car to arrive. With more cars available, the operating costs per trip also drop, as the time to drive to pick up a passenger is reduced and replaced with revenue-generating time when there are passengers in the car.

The operating companies need to have enough drivers and vehicles from the start to service an area efficiently, and they must also gain market share quickly to retain and sustain their drivers in this business.

“COVID added to this barrier. The decline in customers meant less passenger volume, especially at peak weekend times when restaurant and entertainment travel would normally produce a shortage of taxis and an opportunity for new TNS entrants,” reads the report.

“It is apparent from the data that international companies with good access to long-term capital were able to overcome the additional cost and scale barriers imposed by COVID and launch their services, while smaller companies were not.”

Taxi parking lot in Metro Vancouver in April 2020 during COVID-19. (Shawn Sviridov)

Fluctuating number of trip volumes for Transportation Network Services (TNS), also known as ridehailing (Uber/Lyft), within BC’s TNS Region 1 of the Lower Mainland and Sea to Sky Corridor. Click on the image for a larger version. (Hara Associates/BC Passenger Transportation Board)

Moreover, the user-friendly apps of Uber and Lyft have replaced some of the need for taxi dispatch services, and their business model with flexible fares — instead of the metered rates of taxis — has proven to be particularly advantageous to both companies during the pandemic.

Taxi and ridehailing companies operating in this region are currently enduring a driver shortage, but the impacts are different for each service type. Taxi company margins may be narrowed by fixed meter rates to the extent that they are unable to retain drivers, even though the taxi demand justifies it. These drivers will then move to ridehailing, where the hourly earnings are higher because of the higher average rates and the high passenger demand, according to the study.

“Fares rise when there is a shortage of vehicles and drivers, attracting more drivers and deterring some customers who will wait for a less busy time. This is an advantage for customers in that it allows reliable supply in peak period, at least for those willing to pay. It is also a disadvantage to customers in that the rate is not fixed, and those wishing to return home on a Saturday night may face a higher fare than they planned for. For fixed rate fares – taxis are the alternative offered by the system,” states the report.

“However, in the face of an ongoing driver shortage, taxis can be put under a rate-squeeze. During a driver (and therefore vehicle) shortage, passenger demand can exceed supply. This will drive up TNS rates, a mixed blessing since the higher rates mean fewer customers, but the higher rates also retain drivers and attract more of them. Since taxi companies have fixed fares, their ability to raise returns to drivers is more limited. During a shortage, taxis will be busier. However, at a given meter rate there is a limit to how many fares can be carried and to the amount that can earned at a fixed meter rate.”

The PTB’s continued requirement of a Class 4 commercial licence for ridehailing drivers has also contributed to the shortage of drivers, with ridehailing and taxi companies competing for some of the same pool of experienced drivers. As well, the pandemic’s impacts on ICBC last year has meant cancelled in-person tests and a large backlog and wait time for upgrading to the required licence.

Uber service map in Metro Vancouver and the Fraser Valley, January 2021. (Uber)

Lyft service map in Metro Vancouver, January 2021. (Lyft)

Overall demand for these services will continue to trend upward in the near term.

As of this fall, employment in Metro Vancouver has rebounded to pre-pandemic levels, although workplace changes affecting transportation demand remain, with the larger return of workers to their offices delayed this fall due to high coronavirus case numbers.

Hotel occupancy in Vancouver and Victoria reached pandemic-time monthly highs of 50% and 62%, respectively, in July 2021. But this occupancy was likely the result of demand largely driven by provincial residents — not those arriving by air travel due to the travel restrictions at the time.

A significant segment of the taxi and ridehailing demand are driven by trips to and from Vancouver International Airport (YVR). Passenger volumes at YVR in April 2020 collapsed to just 3% of the month’s normal volumes. As of November 2021, with many of the earlier travel restrictions lifted, YVR’s average volumes have rebound substantially to an average of 30,000 passengers per day, but this is still well below the pre-pandemic average of about 78,000 daily.

The Port of Vancouver’s major cruise ship business at Canada Place also provides significant business for taxi companies on a seasonal basis. A major rebound of cruise ship traffic is anticipated for 2022, after the federal government rescinded the ban earlier this month on cruise ships at Canadian ports.

On public transit, TransLink’s ridership rebounded from the pandemic low of 17% in April 2020 to over 57% as of October 2021.

- You might also like:

- Uber drivers in Metro Vancouver making average of $24 per hour after costs

- Uber announces plan to launch ridehailing in Victoria and Kelowna

- Metro Vancouver residents believe ride-hailing is better than taxis in key factors: survey

- With few riders, Metro Vancouver taxi parking lots are looking full (PHOTOS)