Vancouver has the highest single-family property taxes in Canada: SFU professor

New data compiled by Dr. Andrey Pavlov, a finance and real estate professor at Simon Fraser University, shows single-family dwelling property owners in the City of Vancouver are paying the highest property taxes amongst Canada’s major urban centres.

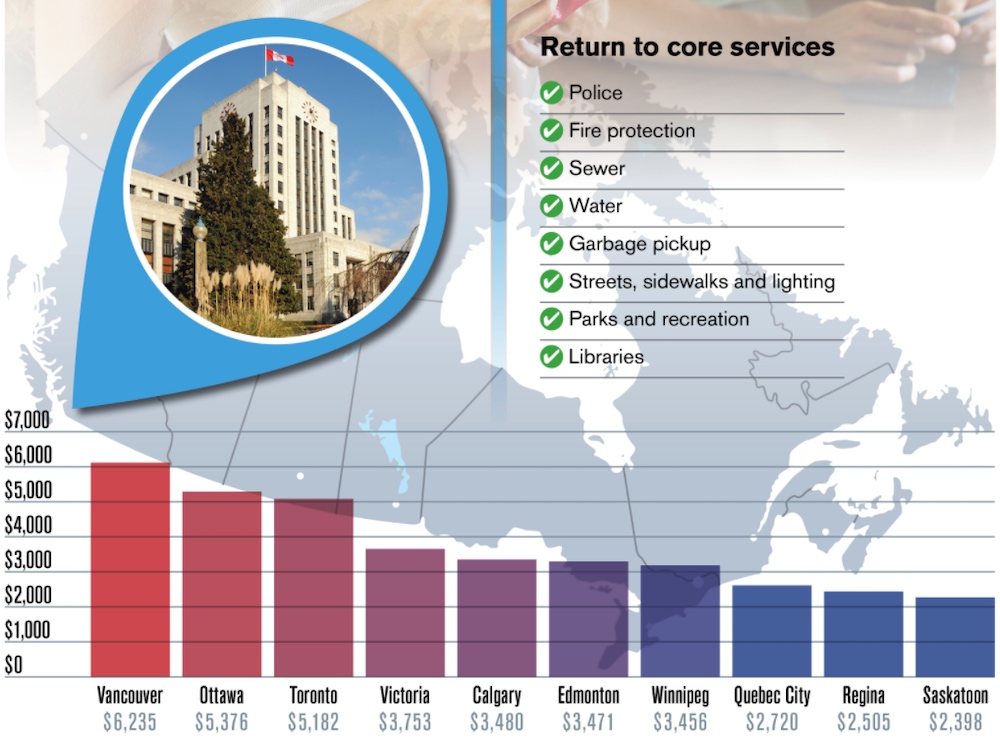

As of June 2019, Vancouver’s single-family dwelling homeowners paid an average of $6,235 in annual property taxes to their municipal government, just after Ottawa at $5,376, Toronto at $5,182, Victoria at $3,753, and Calgary at $3,480. This does not include the additional school property tax.

- See also:

Furthermore, with a 7% property tax increase for 2020, Vancouver had the second highest property tax hike in the country this year.

This tax increase, approved by city council prior to COVID-19, is triple the inflation rate or the wage increases of most people.

Highest property taxes amongst major Canadian urban centres. (StepUp)

According to Paul Sullivan, the managing partner of property appraisal and consulting firm BCS Real Estate, the high property taxes and the 2020 tax hike “prop up ballooning budgets for non-core services.”

Vancouver, in particular, has been expanding its mandate far beyond the core services and responsibilities of a Canadian municipal government, including social programs for the homeless, affordable housing, and healthcare initiatives for the opioid crisis. These areas are typically the responsibilities of the provincial and federal governments.

Core services and responsibilities of municipal governments are police, fire protection, sewage and water infrastructure, garbage pickup, street cleaning, snow removal, road and sidewalk maintenance, parks and recreation, and public libraries.

But with the growing emphasis on non-core services, Sullivan says it is increasingly apparent there is a growing strain on Vancouver’s ability to maintain the core mandates at an optimal level while also keeping property tax increases low.

This ultimately means Vancouver property owners are increasingly paying higher property taxes for less services.

All the while, the municipal government’s staffing costs have increased by 21% over the past decade, even though Vancouver’s population grew by only 10% over the same period.

Pavlov highlights comments recently made by Mike Harcourt, a former Vancouver mayor and BC NDP premier, who said the property tax was only designed to pay for the core municipal services and responsibilities, not the billions of dollars needed to support senior government responsibilities such as affordable housing, post-secondary skills training, and education.

High commercial property taxes have also made it difficult for small businesses to survive, long before COVID-19.

Prior to the pandemic, the provincial government announced a five-year interim relief measure of providing municipal governments with the option to reduce the property taxes of struggling businesses and non-profit organizations. To ensure municipal budgets are unaffected, the provincial government will provide a subsidy to municipal governments to offset the reduced property tax revenue collected for the allocated tax relief.

Of course, with COVID-19, both the federal and provincial governments have rolled out various new programs to support residents, businesses, and workers, but to say the least many continue to struggle from the severity of the depressed economic conditions.