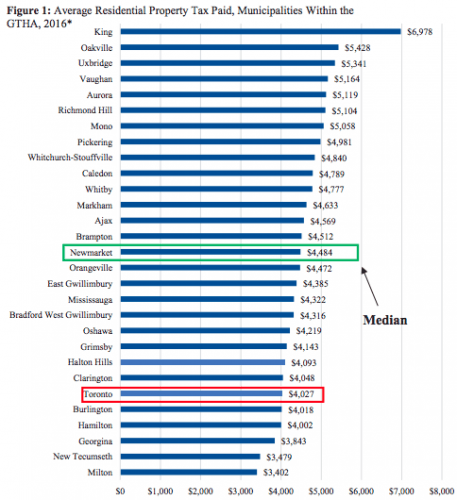

Toronto has the sixth lowest property tax in the GTHA: report

To help pay for Toronto’s growing infrastructure and services required by residents, a new report recommends increasing property taxes by as much as 20%.

According to the report, only five out of 29 municipalities in the GTHA charge less than Toronto.

The report, which was published last Thursday, is based on an analysis of unpublished data from the 2016 Census.

See also

- January saw highest one-month Canadian rental rate spike in 30 years: StatsCan

- Average price for a detached home in Toronto now nearly $1.3M

- These are the 5 cheapest rental listings in Toronto right now

King City tops the list, with the average homeowner paying $6,978 compared to Toronto’s average of $4,027, a $2,951 difference.

In 2016, with the average Torontonian paying $4,027 in taxes, the city sits $457 below Newmarket, the GTA median.

The Ryerson researchers suggest that if Toronto did raise its property taxes by 20%, it would “still be in the middle of the range of taxes levied by 28 other municipalities within the Greater Toronto and Hamilton Area (“GTHA”).”

Across the Greater Toronto and Hamilton Area, more than 20 municipalities recorded a higher effective tax rate than Toronto, wrote the report’s author, Frank Clayton, a senior research fellow at Ryerson University’s Centre for Urban Research and Land Development.

“Only homeowners in Milton, New Tecumseth, Georgina, Hamilton and Burlington paid less,” he continued.

Ryerson University

Toronto city council is voting on property taxes on Thursday, March 7.