Today in news of post-lockdown employment trends, Toronto office vacancy rates just hit their highest level since 1995.

Try as some industry trendsetters might to get employees back at their physical offices, scores of Canadians continue to work from home on a permanent or hybrid basis, and it’s showing up in a big way on historical commercial data charts.

Some employers are noting resistance among staffers who prefer the flexibility and comfort of working from home, forcing them to implement talent-repelling policies that leave their chairs bare either way.

Others have adapted to the times by downsizing (or “rightsizing”) their office offerings, ditching large downtown spaces for smaller, less-traditional digs.

blogTO: Shopify backs out of lease for massive new office space in downtown Toronto.https://t.co/hBizLzPYjH expecting more of this going forward. All the conversations I am having with large enterprise clients is that they will continue to reduce footprint and reduce in office.

— Kenneth Cheung (@kennethdavid) December 15, 2022

The result of these (and I’m sure myriad other) trends has been an uptick in available commercial lease space across the entire country —one so pronounced in downtown Toronto, specifically, that Canada’s largest city just reached its highest overall vacancy rate in nearly 30 years.

A new report released by the multinational commercial real estate services and investment firm CBRE this week states that the overall national office vacancy rate increased at 17.7% over the first quarter of 2023.

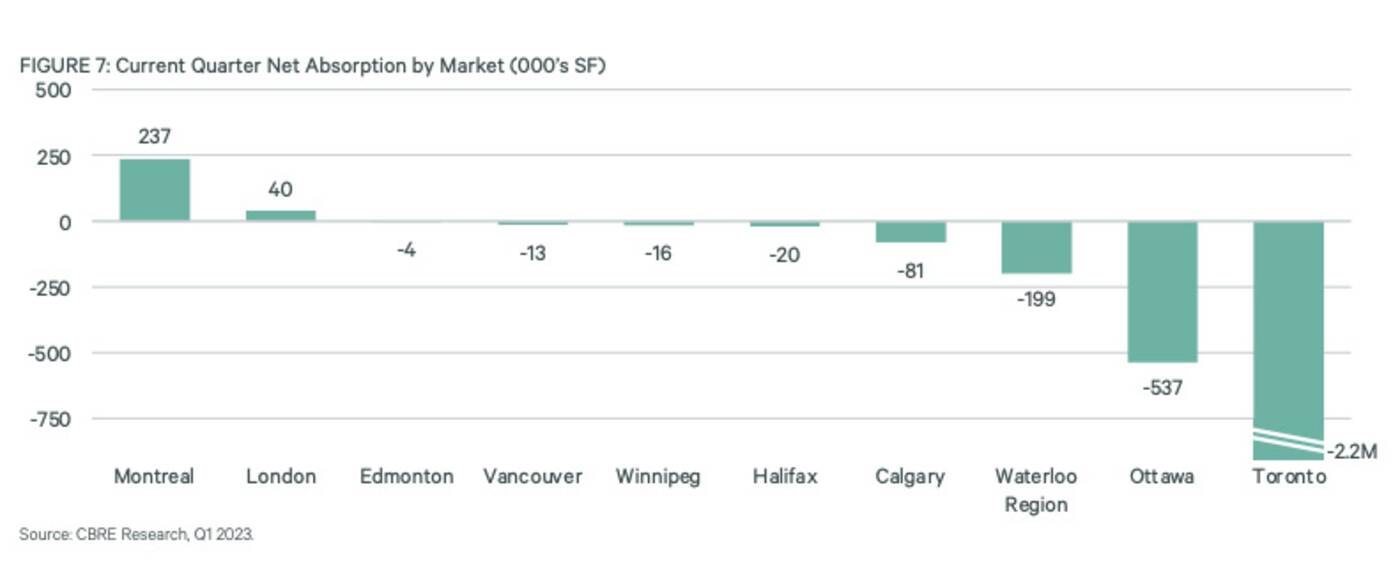

“This is the second consecutive quarter of negative net absorption, with Q1 largely on par with the prior quarter,” reported CBRE on Tuesday. “Six of 10 markets saw muted levels of change with less than 100,000 sq. ft. of either positive or negative net absorption.”

Speaking of net absorption (defined as the sum of square feet that became physically occupied, minus the sum of square feet that became physically vacant during a specific period), Toronto is in quite a negative space… like, way more so than other major and minor cities in Canada, as evidenced by the graph below.

CBRE reports that national net totals were swayed by Toronto over the first quarter of 2023, where “tenants are focused on rightsizing efforts as they gain greater clarity around their space needs.” (CBRE)

Eek.

The commercial real estate juggernaut explains the significance of these trends for markets like Toronto and Vancouver, noting that “only three years ago, tenants in search of a typical 5,000 sq. ft. unit may have had fewer than five options” in either of these cities.

“Today, options are much more numerous, and companies now have the opportunity to find spaces that align with their corporate identity and are located adjacent to core transit hubs,” reads the new CBRE report.

With fewer developers now venturing to create new office spaces amid a lack of demand in urban centres, the market really does seem to have turned in favour of commercial tenants.

“Faced with higher vacancies, increasingly fewer projects have commenced construction in recent years. Currently 11.2 million sq. ft., the active development pipeline is equal to 2.3 per cent of inventory and is at its lowest point since 2017,” notes CBRE. “New project starts are only really being seen in the suburbs.”

Office vacancy continues to rise as the Canadian office sector undergoes a once-in-a-generation evolution. Read more in our new Q1 2023 Figures reports: https://t.co/NzfONsKgYE pic.twitter.com/lm1oIFu8Rb

— CBRE Canada (@cbreCanada) April 4, 2023

In more positive news for employers who want ample office space, CBRE’s analysis found that commercial rental rates (unlike residential rental rates) have actually held stable “across all product types nationally on a three-year basis.”

Companies that would rather sublet than sign on for a lengthy lease commitment are also in a better position right now than they would have been before the public health crisis.

“The new year brought more sublet opportunities to the market. Now equal to 3.4 per cent of existing inventory, sublet space has risen nationally for three consecutive quarters,” reads the new report.

“The largest increases in sublet space meanwhile were found in Toronto and Ottawa this quarter.”