Toronto has the fastest-rising prime home prices in the world

Toronto officially has some of the fastest-rising home prices in any major city in the world, according to a new report.

Although it may be something any Torontonian could have easily guessed, the recently published Prime Global Cities Index from Knight Frank confirmed that Toronto’s prime residential real estate prices are far outpacing other major cities.

Prime real estate is defined as the top 5% of the real estate market.

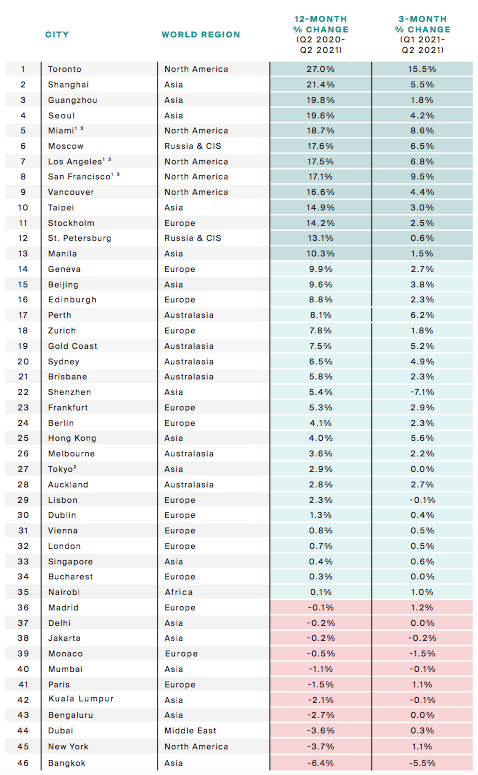

Toronto beat the next closest city — Shanghai, China — by several percentage points, with Toronto’s prime real estate prices rising 27% year-over-year and 15.5% quarter-over-quarter. Shanghai’s rose 21.4% and 5.5%, respectively.

“Toronto leads this quarter’s results, recording annual prime price growth of 27%, driven by strong buyer appetite and low inventory levels,” the report reads.

Guangzhou, China; Seoul, South Korea; Miami, Florida; and Moscow, Russia, round out the top five.

Knight Frank

Canada’s third largest city, Vancouver, also made it on the list, coming in at number nine with 16.6% growth year-over-year and 4.4% quarter-over-quarter.

“Housing markets are undergoing the most unusual of recoveries,” the report reads. “An easing of travel rules in some markets, a surge in safe haven purchases by domestic buyers, a flurry of activity ahead of the tapering of stamp duty holidays, and an overall reassessment of lifestyles and commuting patterns, all set against a backdrop of low interest rates.”

Interestingly, a number of major cities like Paris, Dubai, New York, and Mumbai actually saw declining prime residential real estate prices both year-over-year and quarter-over-quarter.

- See also:

As for what’s next, Knight Frank predicts that the prospect of rising interest rates, government intervention, and the withdrawal of stimulus measures will help to rein in the market later this year.

“Expect more cooling measures as policymakers grapple with the affordability conundrum,” the report reads. “The Chinese mainland’s long-debated national property tax now looks more likely. We expect to see London, New York, Paris and Dubai move up the rankings in Q3 as travel restrictions ease and international buyers start to recognize the relative value in these cities.”