BC drivers pay up to 42% more on auto insurance than Albertans (STUDY)

Despite auto insurance in British Columbia and Alberta having many similarities, drivers in BC could be paying up to 42% more on their premiums than their Albertan counterparts.

That’s one of the main findings from a new report from accounting firm MNP. The study, which was published by the Insurance Bureau of Canada (IBC), says that while insurance between the two provinces is “substantially the same,” the “price drivers are paying, however, is very different.”

According to the IBC, the two provinces share the following similarities in their auto insurance:

- Tort-based systems with the ability to sue for pain and suffering

- A similar limit on pain and suffering awards for minor injury claimants

- Similar mandatory coverage

- Similar average payouts for injury claims ($50,658 in BC; $46,082 in Alberta)

The study says that the main difference between the two provinces is that ICBC, a crown corporation, has a monopoly on auto insurance in BC, whereas drivers in Alberta have a choice.

“In the study, MNP found that BC Drivers are paying up to 42% more for their auto insurance than their neighbours in Alberta pay for similar coverage,” says the IBC.

To come to this result, the study received quotes from insurance brokers for 14 different driver profiles, both in-person and online. After that, they compared the price of insurance for drivers with the same vehicles, the same coverage levels, and in similar locations.

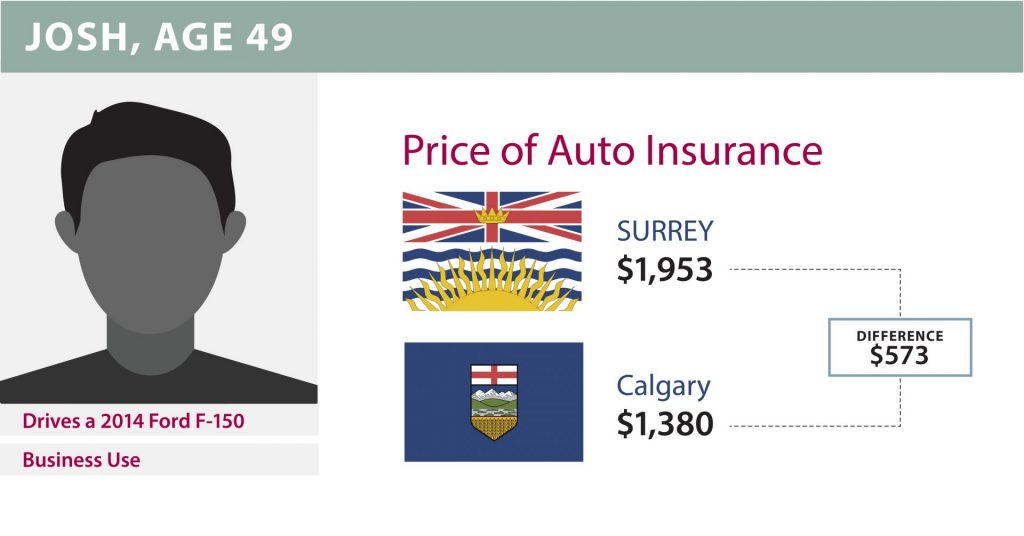

“For example, a 49-year-old small business owner in Surrey who drives a 2014 Ford F-150 would pay $1,953 with ICBC, which is $573 more than what the same individual would pay in Calgary,” says the IBC.

Insurance Bureau of Canada/Twitter

MNP’s study also suggests that “inexperienced drivers in BC are paying far more than the same drivers in Alberta for comparable coverage.”

“A new driver with two years of experience would pay ICBC $4,319 to insure their 2008 Honda Civic to go to and from school (less than 15 km),” writes the IBC. “That is $828 more than the same driver would pay in Calgary.”

Insurance Bureau of Canada/Twitter

The IBC says, however, neither system is perfect and that both provinces are in need of reform. The Alberta government removed limits on rate increases last August, which have caused insurance companies in Alberta to apply for rate increases averaging 10.5%.

ICBC typically implements rate increases in the spring and can only do so after receiving approval from the BC Utilities Commission.

- See also: