These are Toronto’s most expensive condo buildings per-square-foot

The COVID-19 pandemic is changing and shaping the real estate market especially when it comes to condo sales and purchasing in Toronto.

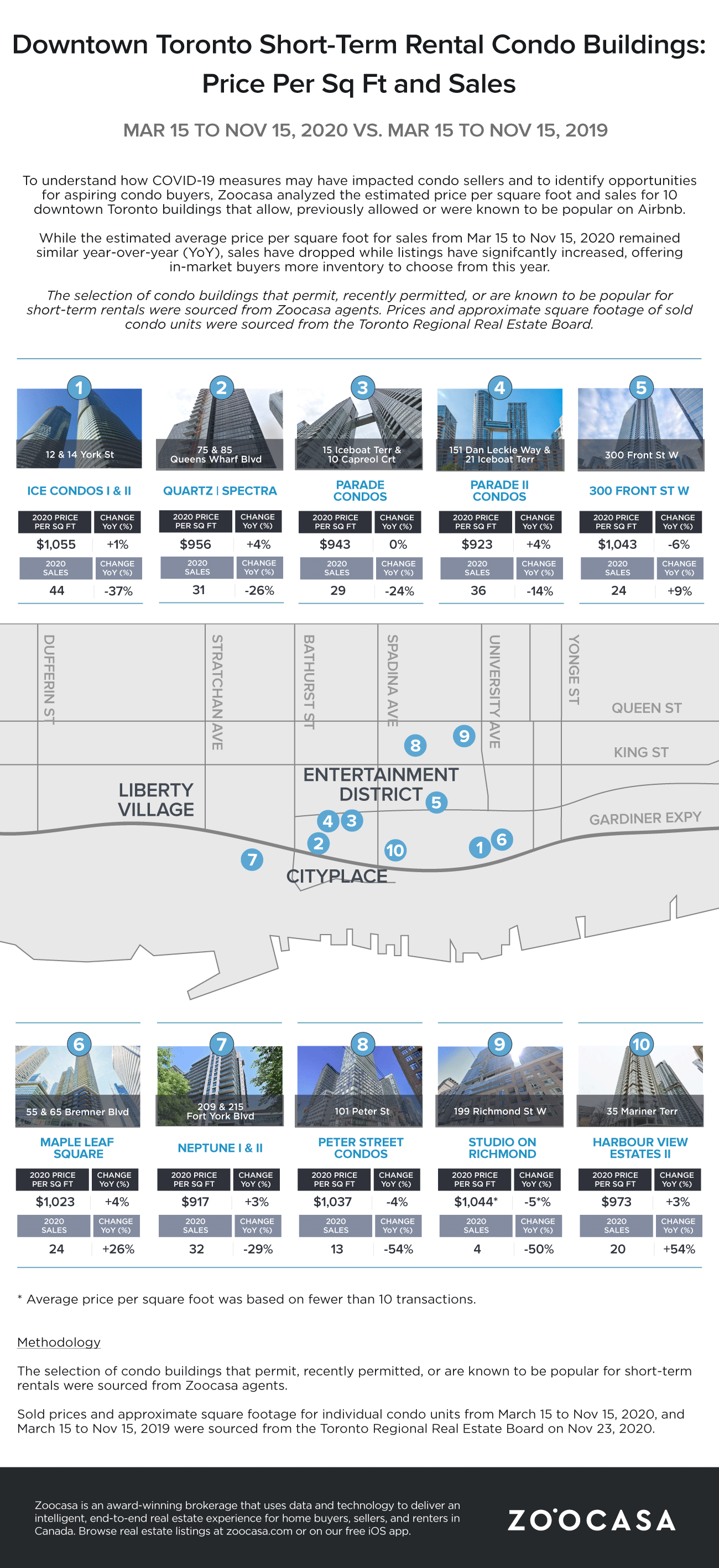

According to a recent report by Zoocasa, in order to understand how buyers and sellers were impacted by the pandemic they calculated the estimated price per square foot and sales for 10 condo buildings in the downtown Toronto area.

These condos were chosen as they were known to be popular short-term rentals.

- See also:

The analysis found that the estimated average price per square foot for sales over the last eight months remained similar to the same time period last year. It also found that sales volumes dropped considerably, in some cases by over 50%.

However, the number of condo listings grew significantly in these buildings, “offering active buyers more inventory to choose from this year.”

Condo Buildings Popular for Short-Term Rentals With Highest Price Per Square Foot

March 15 to November 15, 2020, figures compared to the same period last year:

1. Ice Condos – 12 & 14 York St

- Average price per sq ft: $1,055 (+1%)

- Sales: 44 (-37%)

2. 300 Front St

- Average price per sq ft: $1,043 (-6%)

- Sales: 24 (+9%)

3. Peter Street Condos – 101 Peter St

- Average price per sq ft: $1,037 (-4%)

- Sales: 13 (-54%)

Zoocasa

Among the 10 downtown Toronto buildings included in Zoocasa’s analysis, the estimated price per square foot from March 15 to November 15 ranged from the low $900’s to over $1,000 with year-over-year changes ranging from -6% to +4%.

Half the buildings had an average price per square foot over $1,000, indicating that some of the condo buildings are still priced at a premium compared to condos across Toronto.

Apart from Harbourview Estates II, Maple Leaf Square and 300 Front everywhere else saw sales decline from last year, ranging from -14% at Parade II and -54% at Peter Street Condos.

Emma Pace, a Zoocasa agent in Toronto, said that buyers can have more choice in the downtown market.

“Most of the available supply is being pushed into the sub $1M price point, as much of the inventory is coming up from investors who are cashing out of the market as a result of the slowdown in rental demand due to the pandemic,” Pace said in the report.

Conversely, while buyers have more selection, the competition increases with sellers and properties may stay on the market for longer than in previous years.