BC drivers could be paying up to 60% more than Albertans on insurance: study

A big change is coming to BC’s vehicle insurer, the government-run Insurance Corporation of British Columbia (ICBC), which will soon adopt a few similarities to the system Alberta has in place — but with significantly pricier premiums.

A study from the Insurance Bureau of Canada (IBC) found that some BC drivers may soon be paying up to 60% more than their provincial neighbours across the Rockies, even if they’re on similar plans.

See also

- These are top 10 most scenic airports in the world

- Budget 2019: Canada wants to tax cannabis edibles based on THC content

- Canada named one of the 10 happiest countries in the world in 2019

ICBC announced earlier this year that it would be increasing basic insurance plans province-wide by 6.3%, an increase that was given the green light by the British Columbia Utilities Commission (BCUC) in January.

Last December, BC Attorney General David Eby explained that the increase of 6.3% could have been much worse, had his government not stepped in.

In fact, he commented that the increase could have been by almost 40%.

“Our government has taken on the difficult work of fixing the problems left behind at ICBC,” Eby said. He also stated that the previous government “not only ignored the warning, they hid the solutions from the public.”

Along with the 6.3% increase, ICBC will also come more in line with Alberta insurers by implementing the following points, as provided by the IBC study:

- Tort-based systems with the ability to sue for pain and suffering;

- A limit on pain and suffering awards for minor injury claimants;

- Restrictions on the use of experts and expert reports;

- Similar mandatory coverage levels;

- Similar average injury claim costs: $50,658 in BC and $43,211 in Alberta (2017).

The study also noted that, while there will be many similarities between the two systems come next month, the main difference is that ICBC has a monopoly on mandatory auto insurance while Albertans have a choice — and therefore a competitive market — on how they insure their vehicles.

“This study gives an apples-to-apples comparison of the price drivers are paying for similar auto insurance coverage in BC and Alberta, and clearly demonstrates the price impact of ICBC’s monopoly,” said Aaron Sutherland, Vice-President, Pacific, IBC, in the release.

“With drivers in BC paying up to 60% more for similar coverage than their counterparts in Alberta, the time has come to introduce competition into the BC marketplace and give drivers the choice they deserve.”

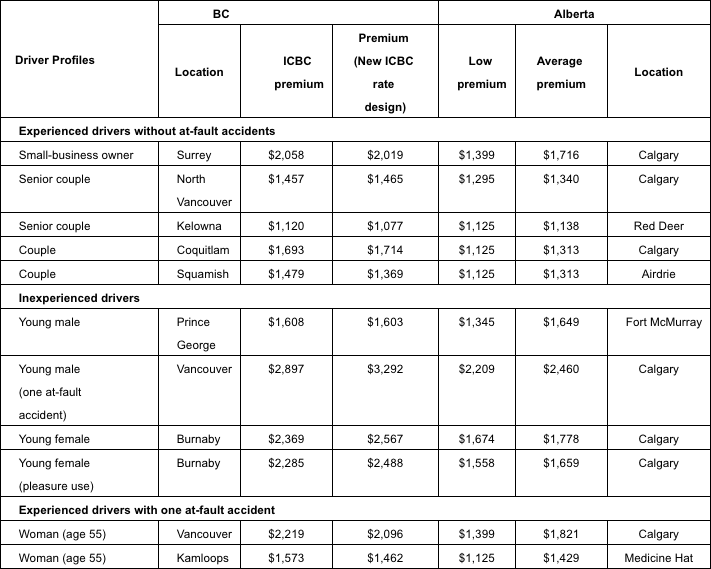

To conduct the study, IBC obtained quotes from various insurance brokers throughout the two provinces for 15 different driver profiles with identical accident history, vehicles, and coverage.

The data was compiled into a table that found ICBC charging more for nearly all types of coverage, with the exception of a senior couple in Kelowna vs. the same couple in Red Deer.

Any comparisons between Vancouver and Calgary rate found Vancouver drivers paying hundreds of dollars more than their Albertan counterparts.

A Detailed Comparison of BC and Alberta Premiums (IBC)

The costliest premium for either province was for young men who had one at-fault accident, seeing $3,292 annually in Vancouver and $2,460 in Calgary — a difference of over $600 per year.

“With the changes coming on April 1, the auto insurance systems in BC and Alberta will be substantially similar, with the key difference being who sells auto insurance in each province,” said Susan Mowbray, Senior Manager with MNP, in the release.

“That difference has contributed to drivers in BC paying more than their neighbours in Alberta for similar coverage.”

The quotes were obtained in February of this year and were provided for the following insurance plan:

- $1 million in third-party liability

- Collision coverage with a $500 deductible

- Comprehensive coverage with a $250 deductible

- Uninsured motorist protection

– With files from Vincent Plana