About a quarter of renters in Toronto are spending more than 50% of their income on rent.

The GTA tops Canada’s list as area where renters spend over 50% of their income on housing, according to the Canadian Rental Housing Index.

Developed by the BC Non-Profit Housing Association, the index tracks everything from average rental costs, to how rental housing spending compares with income, to overcrowding for over 800 cities and regions.

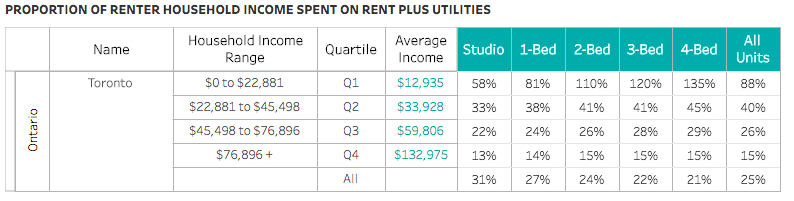

Its recent list shows 23% of renters in Toronto spend over half their household income on shelter, putting a growing number of families and individuals at a crisis level of spending and at risk of homelessness.

“Traditionally, spending 30% or less of household income on rent has been viewed as the benchmark of what is considered affordable,” said Jill Atkey, Acting CEO of the BC Non-Profit Housing Association.

“However, the data shows that spending more than 30% of income on housing has become the new normal for individuals and families in almost all areas of Canada.”

The Housing Association said that the latest data paints a worrying picture for rental housing affordability across the country.

The Index shows over 1.7 million renters spend more than the recommended affordability benchmark of 30% of gross income on rent and utilities, and of those, 795,000 renter households spend over half of their income on housing costs.

In Toronto, the average rent including utility costs were listed as $1,242.

Meanwhile, the Index also shows that average rental costs are outpacing corresponding increases in household incomes.

For example, the Housing Associates said that Ontario saw average rent costs go up 20% over five years compared with average income only rising by 12% over the same period.

Currently, for those in the low-income bracket, they would need to make an average of 195% more in income to afford rent with the standard 30% of before-tax income.

As the cost of real estate increases, more and more people are choosing to rent.

“With escalating prices keeping many Canadians from affording home ownership, as well as a lack of affordable rental housing supply, more people are entering the rental market or staying in the rental market longer,” said Jeff Morrison, Executive Director of the Canadian Housing and Renewal Association.

“This marks the first time in a generation that the rate of Canadian renters has outpaced the number of Canadians buying a home, and speaks to the need to increase the supply of affordable housing.”

The Index will provide housing planners, non-profit developers, and local and regional governments across Canada with the information they need to plan for the future of affordable housing in their respective regions.

Hopefully, solutions can be made soon.